Solution

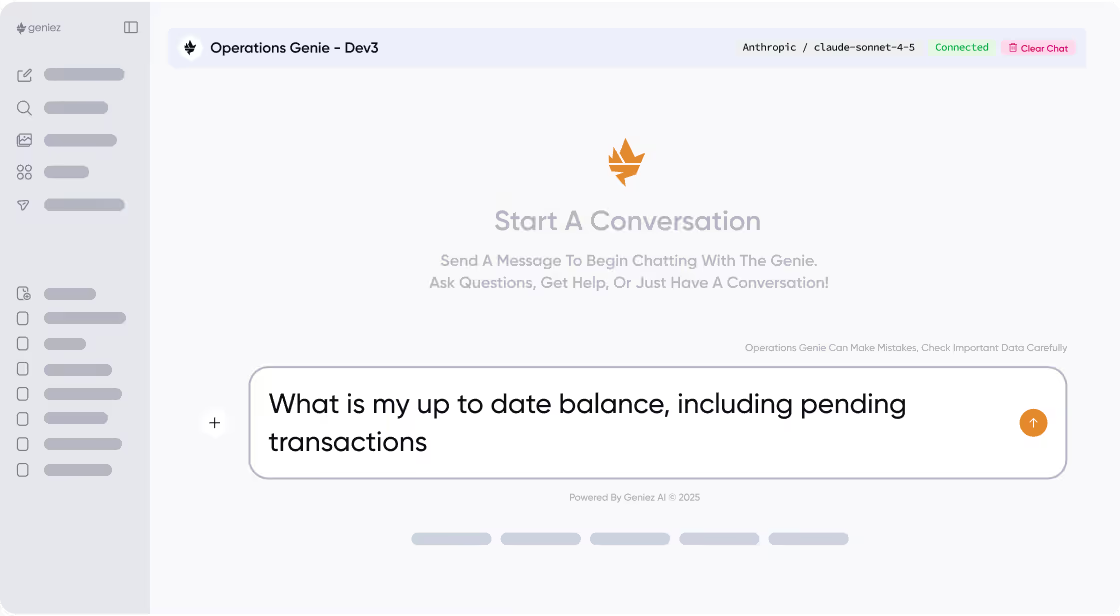

Business units require reports and analytics from their data to create new customer offerings. Currently, business users rely on the IT team to run SQL queries and provide this data, causing delays for every request or modification. By connecting LLMs to mainframe data, business teams can query data in real-time using natural language, eliminating the need to learn mainframe or wait for support. This allows the business to rapidly develop new offerings and enhance client experience.

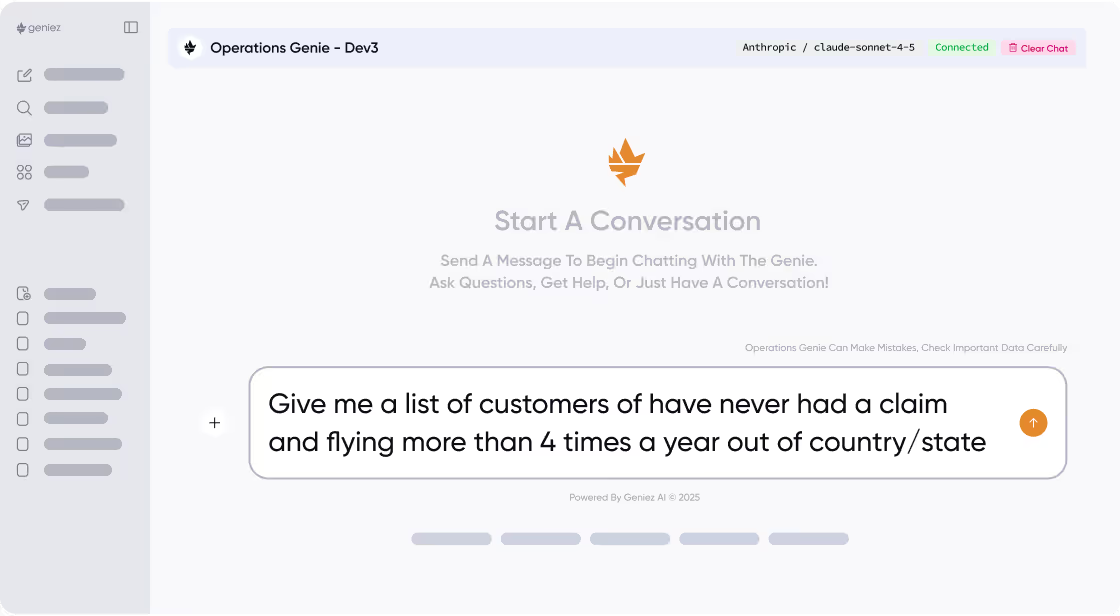

The digital assistant, an early use case for generative AI, allows clients to access information in natural language, reducing the need to contact an employee. Across industries, connecting these assistants to real-time mainframe data provides employees and customers with immediate, accurate information. This enhances customer satisfaction and cuts operational costs.

Insurance

Banking

Retail

Telecom

Manufacturing

Generative AI excels at finding a needle in a haystack. Banks often rely on manual devops anomaly detection, like a human sifting through millions of credit card or ATM transactions for irregularities. Connecting GenAI to mainframe data allows natural language queries to analyze credit card and ATM activity for anomalies. This process takes minutes, requires no human intervention, and produces a report highlighting irregularities.

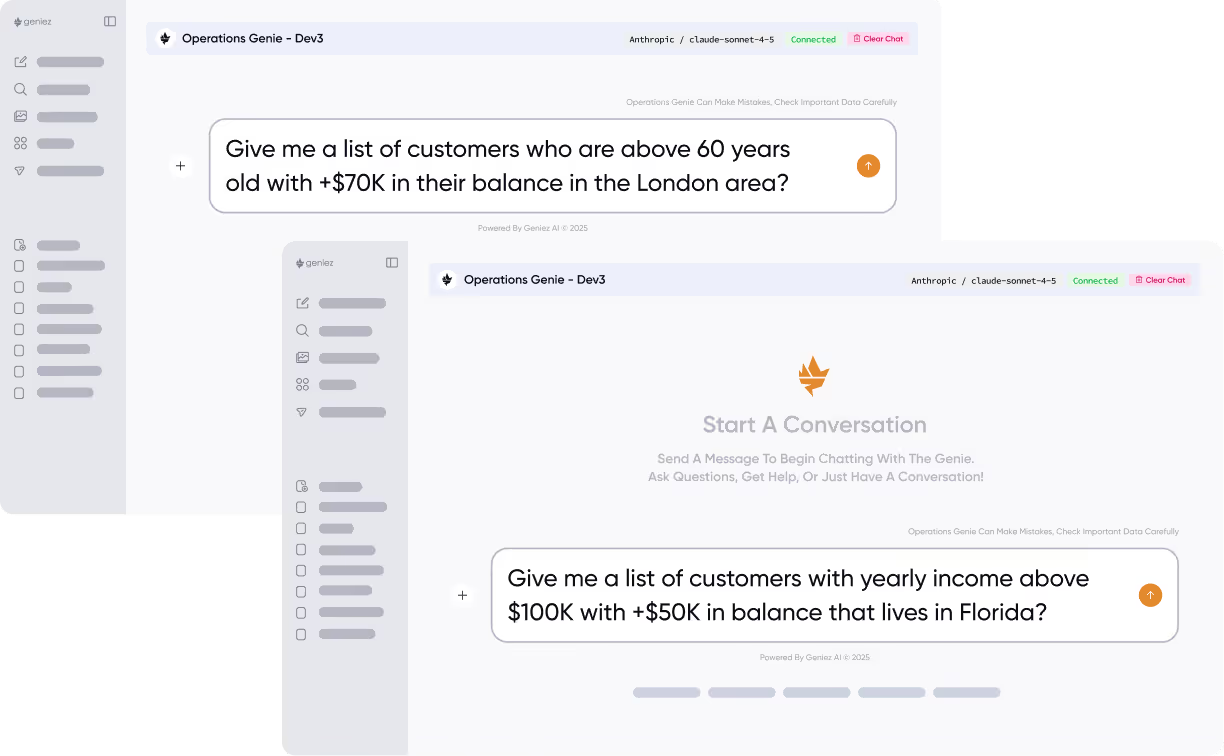

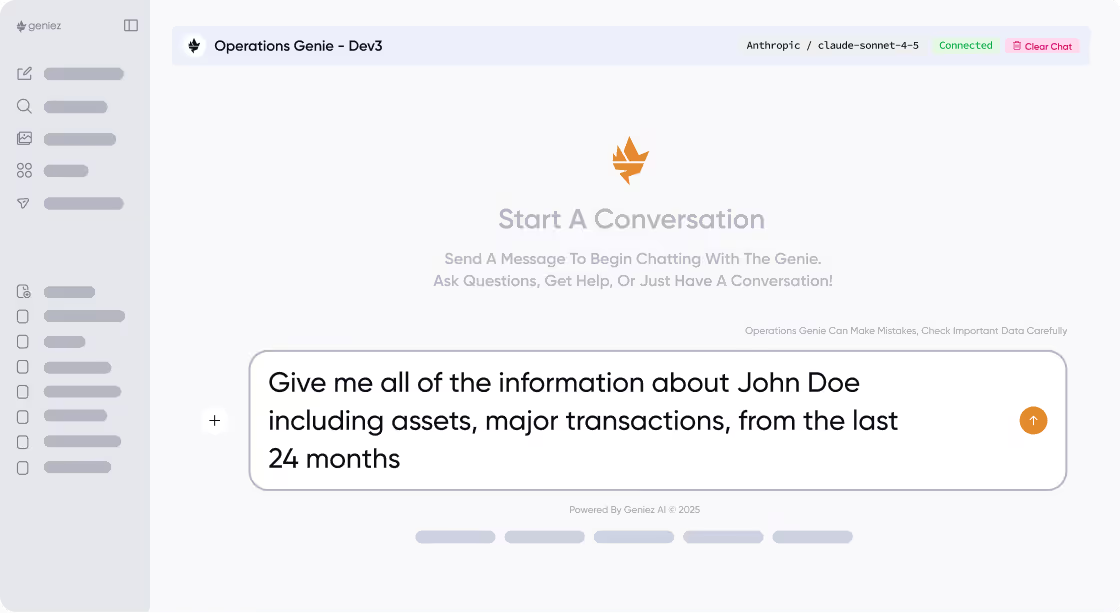

Financial advisors waste up days gathering customer data from distributed systems and mainframes before meetings. This is inefficient for an expensive resource. By connecting Generative AI to mainframe data, advisors can use natural language queries to instantly retrieve all necessary customer information. This allows financial advisors to focus on customer meetings and sales instead of data gathering.

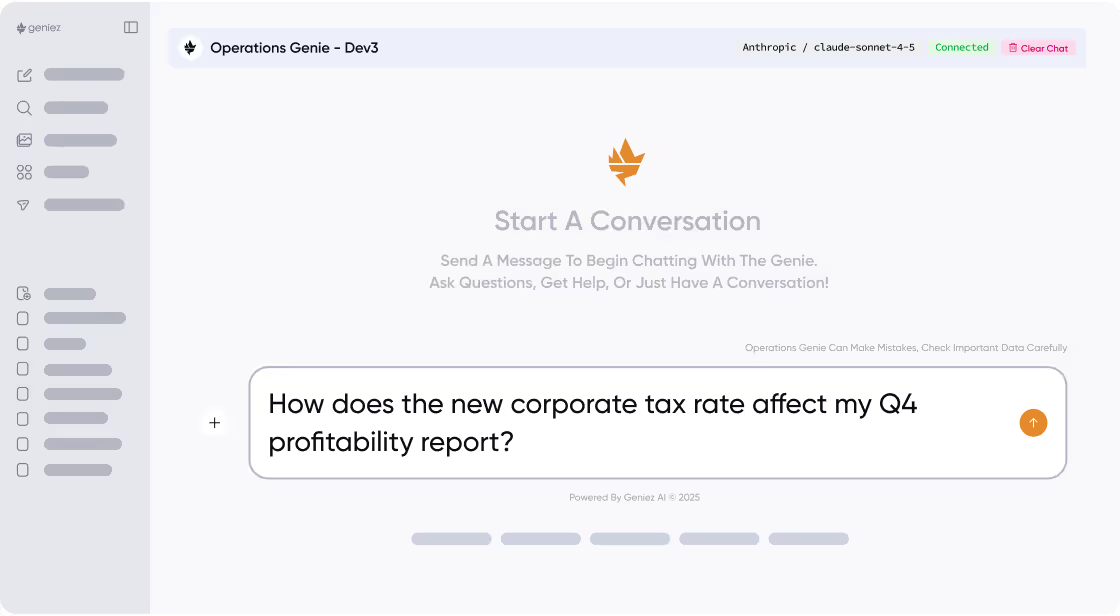

Traditional compliance updates demand costly, complex COBOL modifications to mainframe applications. By linking Generative AI to real-time mainframe data (customer records, transactions, filings), organizations can bypass code changes. Users can ask natural language queries about new regulations and receive accurate, data-driven answers synthesized directly from existing mainframe data, thus accelerating compliance verification and mitigating legacy code modification risk.

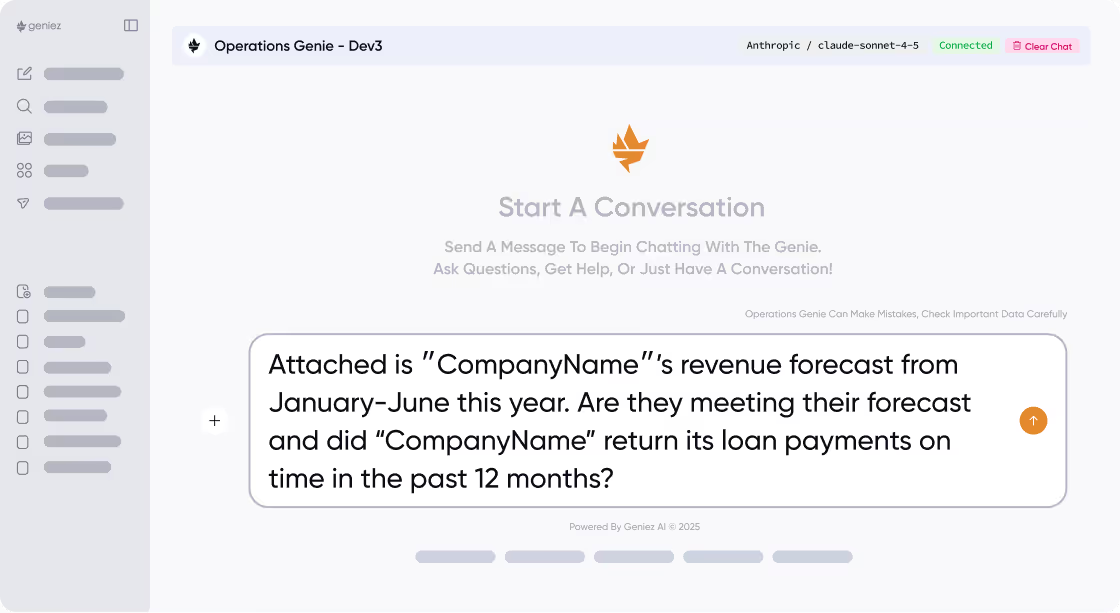

Banks assess business credit lines using loan repayment history and collection/sales forecasts. Traditionally, some banks manually check business loan compliance every three months. Generative AI allows bankers to instantly verify if businesses are meeting collection and sales forecasts. This automates the work, boosting banker efficiency and, crucially, reducing bad debt. If a business misses forecasts, the bank is alerted and can decide to block or limit the credit line.